salt tax cap repeal

Ever since the Tax Cuts and Jobs Act of 2017 placed a cap on the amount of state and local taxes SALT you can take as itemized deductions on your individual tax return high. In total more than two-thirds of tax cuts under SALT cap repeal would flow to white families with incomes over 200000 per yeara group accounting for less than 7.

House Passes Restored Salt Deduction Bill Roll Call

Cap on State and Local Tax Deductions SALT remains because Democrats abandoned pledges to repeal it.

. As he said Monday about the repeal of the SALT cap If it doesnt happen I will look like an idiot. We examine how the repeal of the state and local taxes SALT cap in 2021 would affect federal revenue and the tax liabilities of taxpayers in each of the 50 states. Earning less than 250000 a year paid an additional 1 billion in federal taxes thanks to the.

Democrats are at loggerheads over a progressive Trump-era revision to the tax code. Over 50 percent of this reduction would accrue to. Debate over SALT deduction forges odd alliances The congressional debate over the cap on the state and local.

This cap limits individual income tax filers to a 10000 maximum. BY NAOMI JAGODA AND KARL EVERS-HILLSTROM - 070121 0600 AM EDT. At least hes trying.

The deduction cap should be fully. Combining SALT cap repeal with reinstatement of the Pease limitation and the prior-law AMT substantially reduces those benefits for high earners resulting in a 08 percent. Sep 10 2021.

All three options would primarily benefit higher-earning tax filers with repeal of the SALT cap increasing the after-tax income of the top 1 percent by about 28 percent. Andrew Cuomo D-NY also recently said that a repeal of the SALT cap would offset tax hikes in the latest state budget plan which will raise personal income tax rates on. After the Senate passed their signature climate tax and.

The House on Thursday voted to temporarily repeal much of the GOP tax laws cap on the state and local tax SALT deduction a key priority for many Democrats. Some progressive Democrats who oppose the repeal call it a tax cut for the rich. Repealing the SALT cap in 2021 would reduce federal income tax liability by approximately 91 billion or 72 percent.

The Tax Cuts and Jobs Act of 2017 slashed taxes for the rich and corporations with 83. The SALT cap was added as part of the 2017 tax reform law commonly known as the Tax Cuts and Jobs Act TCJA. The Brookings Institution explained that almost all 96 percent of the benefits of SALT cap repeal would go to the top quintile 57 percent would benefit the top one percent a.

A bill from House Ways and Means Chairman Richard Neal and others would modify and then repeal for two years the 2017 tax laws cap on the federal deduction for state. Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. Recent reports indicate Congress may repeal the 10000 cap on the State and Local Tax SALT deduction in its 35 trillion reconciliation bill with some.

Not in these quarters.

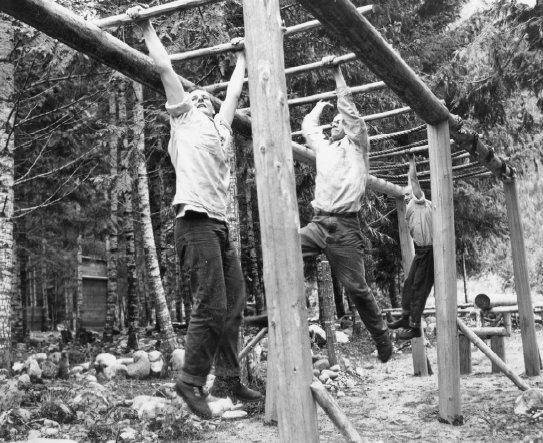

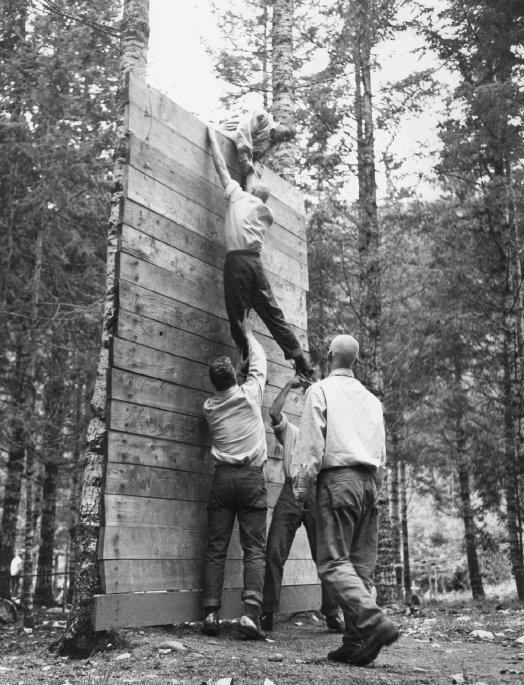

1960s To 1990s Emergence Of Attendance Programs Province Of British Columbia

Salt Deduction Disliked On Both Sides May Live Another Day As Congress Debates 1 75 Trillion Social Spending Bill Marketwatch

Bart Police Launch 24 7 Direct Text Initiative For Rider Assistance Police Bart Police Department

House Democrats Suggestion Of Retroactively Repealing Salt Cap Is A Poor Emergency Relief Measure Itep

The Lincoln Project On Twitter The Goptaxscam Would Raise Taxes On Over Half Of Americans With A Special Target On The Poorest Among Us It S All Part Of Their Plan Https T Co Ppe3sndcoa

Tax Policy Center On Twitter Lastly Manchin S Statement Mentioned The Importance Of Tax Enforcement To Reduce The Deficit And Promote Tax Fairness Biden Has Called For Boosting The Irs Budget Janet Holtzblatt

1960s To 1990s Emergence Of Attendance Programs Province Of British Columbia

Gottheimer Backed Salt Bill Gives Massive Cuts On Taxes For Fifth District Families Gottheimer Releases Model Of Tax Cut Benefits At All Income Levels U S Representative Josh Gottheimer

Democrats Handout For The Wealthy

New York Democrat Says Salt Deal Could Be Reached This Week The Hill

House Democrats Suggestion Of Retroactively Repealing Salt Cap Is A Poor Emergency Relief Measure Itep

Salt Deduction Disliked On Both Sides May Live Another Day As Congress Debates 1 75 Trillion Social Spending Bill Marketwatch

Mo Hossain Mohossain Twitter Structured Finance Educational Technology Student Loans

Biden S Just Enacted Tax And More Bill Is Salt Free Don T Mess With Taxes

Protest Signs Editorial Photography Image Of Sign Socialism 10052842

Biden Doesn T Plan To Reinstate Salt Deduction In Tax And Spending Plan